Putting our hard earned money in the stock market is a risky business. We may have put in our best research effort to ensure that all the financial, valuation and management factors are tip-top but there will be some hidden or external factors which investors do not know. We all do not want to see our portfolio lose money. It's risky to invest in stock market. We cannot eliminate risk but we can reduce our risk. So what do we do? We buy more individual stocks :) Study has shown that as we diverisified by buying into different stocks, our portfolio risk reduces. So when a particular sector or single stock is not doing well, it will not have a big impact on your portfolio as a whole. However, when there's a systematic risk of a global crisis eg the Great Financial Crisis in 2008, every stocks in the stock market will fall. That will affect your portfolio too.

The following will be what I will be doing.

Stock Diversification

Keep to the 5% rule. Try not to have more than 5% of the individual stocks in your portfolio. So that any bad things happening to your single stock is only 5% of your overall portfolio. It will not caused a dent in your portfolio. In order to get the magic 5% figure, you need to invest at least 20 different stocks so that they will make up 100% of your portfolio. Basically, I will be trying to build my own ETF with 30 to 40 stocks for a start.

Sector Diversification

Currently we have oil price dropping from US$100+ to below US$50, this has caused O&M related stocks such as Keppel Corp, Sembcorp, CH Offshore, etc tumbling down as much as 27%. Do be careful not to keep picking up these stocks from the same sector and over exposed yourself to the O&M sector. Keep to the 20% for each sector.

Geographic Diversification

We are lucky to be in Singapore while it strived to be a financial hub, there are lots of companies listed in SGX with foreign investments such as Saizen REIT (Japan), Mapletree Greater China REIT(China), Hutchison Port Trust(HK), Ausnet(Australia), etc. Many of our stocks in SGX have investments in different countries such as Hong Kong, China, Japan, Indonesia, US and Malaysia. These are the countries which most of the SGX stocks are vested. It's about 15% in each countries so pretty much diversified already. At this moment, I am concentrating on building my portfolio buying local stocks in SGX. In the future, I may want to buy stocks from US or Hong Kong to spread out my geographical risk. However, it seems quite expensive to buy foreign stocks as we need to pay extra handling fees for our overseas dividends which I do not find it worthwhile. I may be considering buying high dividend ETFs which consists of a list of 30 to 40 dividend stocks. Any good idea on buying foreign stocks please share :)

Asset Diversification

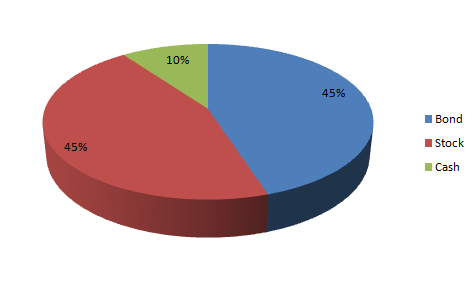

Just now we mentioned about global stock market crisis, so how do we reduce our risk when that happens? We diversify our assets namely stocks and bonds. I am treating my CPF savings as bonds currently earning 2.5% and 4%. If you have read my profile, you would have known that I have maximised my SA savings so I have a pretty build-up bond asset in my portfolio. In this blog, I will be focusing more on my stock asset.

No comments:

Post a Comment